Small businesses face auto enrolment deadline

In late January, The Pensions Regulator (TPR) released its latest quarterly figures showing how effectively employers are complying with the auto enrolment pension regime.

Its report* showed a rise in notices issued to non-compliant employers, as more medium-sized businesses reached their ‘staging date’.

Why are more employers being affected?

Auto enrolment is being phased, or ‘staged’, depending on an employer’s size. The first staging date for the largest employers (120,000+ employees) was 1 October 2012. Over the past two years, more businesses have gradually been required to meet the new rules and on 1 August 2015, the staging date for smaller employers with between 04 employees) begins.

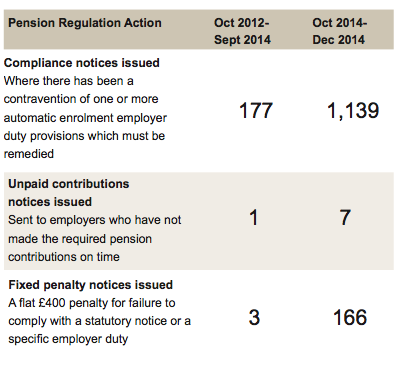

Action taken against non compliant employers

For the two month period between October 2014 to December 2014, 735 issued, compliance notices – a 500% increase compared to the 177 compliance notices it issued for the two year period between October 2012 to September 2014.

There was a sharp increase in fines too: £400 fixed penalty notices were issued for the period between October 2014 to December 04, compared to just three between October 2012 to September 2014.

The jump in notices issued reflects more medium sized employers being affected by auto enrolment. Around 30,000 employers with approximately 62 to 149 workers reached their auto enrolment staging date in April 2014 to July 2014 and completed their declaration of compliance with auto enrolment law by the start of December 2014.

Plan ahead to avoid being penalised

TPR has repeated its warning that employers should start the process of auto enrollment planning a year before their staging date. It also added that ³failing to declare within five months of your staging date means you risk being fined.

If your business is yet to enter the automatic enrolment process, do not leave things until the last moment. The sooner you start, the more likely you are to meet your obligations – and avoid a potential fine.

* Automatic enrolment: compliance and enforcement, quarterly bulletin, 1 October – 31 December 2014

Content reproduced by permission of Openwork Ltd.